Our investment strategy is to ride the wave of innovative mega trends.

And when a big breakthrough causes a massive tidal shift, it takes entire sectors with it.

That’s why we are “Tide Riders.” (We’re mapping out our Tide Riders here!)

You’ve seen the massive tidal wave in artificial intelligence this year with some stocks going as high as 300%.

Now a new tide is coming in…

Thanks to the CHIPS Act, the Inflation Reduction Act and infrastructure laws, manufacturing is coming back to America.

The 10-year-average manufacturing spend from 2010 to 2022 is about $80 billion. This year we are looking at a spend of nearly $200 billion!

The result? Stocks in this sector are also on the rise.

This is a huge tide change.

And a mega trend we want to put on your radar today … on top of a few other tides you’ll want to ride this year.

(Or read the transcript here.)

🔥Hot Topics in Today’s Video:

- Market News: Gas prices are on the rise, but there’s good news! The Federal Reserve might not raise interest rates in September. Here’s why. [2:00]

- Mega Trend #1: Construction spending in the U.S. has taken off! It’s driving the U.S. manufacturing industry — with the help of three huge government bills that recently passed. [8:50]

- Mega Trend #2: AI and machine learning isn’t done innovating and disrupting. Your homeowners’ insurance could get cheaper with this “Insurtech” company making waves in the market. [11:50]

- Investing Opportunity: If you want to invest in the tech behind Insurtech, here’s the perfect exchange-traded fund you can tap into. [15:25]

- World of Crypto: I make a prediction about Ethereum for 2023. It has to do with the bitcoin futures ETF (and not if, but when it will get approved). [17:00]

More Edge: Small Town American Boom 🦾

In a small town of just 5,182 people…

Locals are getting cash offers for over $1 million on their homes that sold for low six-figures just a few years ago…

And one of Wall Street’s biggest investors is behind all of it.

What is going on in this small town? What I’ve seen could mean it’s an opportunity of a lifetime.

I put my boots on the ground to get the full story. I’ll share everything I found out about this small town on Tuesday, August 22, 2023 at 1 p.m. ET.

And my #1 stock recommendation to take advantage of this massive, sweeping trend.

Simply go here to sign up for free, then tune in next Tuesday.

Hope to see you then!

Ian KingEditor, Strategic Fortunes

Special Note: Our hearts, thoughts and prayers go out to the people of Maui, Hawaii. Both Amber and I have traveled to the region (with a lot of fond memories). And we know we have subscribers who live in Maui.

We’re with you in spirit, and we hope you’re safe.

If you want to support Maui during this time, here are a few donation options that we like: Salvation Army, Red Cross and one I’ve volunteered at — Team Rubicon.

A Tale of 2 Inflations

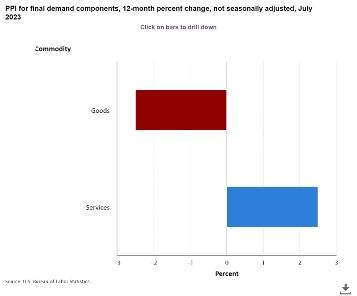

The Producer Price Inflation (PPI) numbers for July came out last week, but buried in the data was one little fact I found interesting.

Producer prices were indeed higher in July … but the increase was driven exclusively by services. The prices of goods, at least at the producer wholesale level, actually fell!

Why Are Producer Prices Important?

Producer prices give us a potential preview of what consumer prices will be like in the coming months.

The prices paid by producers eventually flow through to the final prices paid by us, the consumers, out there shopping for groceries in an inflated market.

The relationship isn’t exact, and there are a lot of moving parts. But producer prices are a leading indicator for what consumer prices are going to be.

So, what are we to glean from this?

The problem is people.

Between higher interest rates sucking demand out of the system and the global supply chain mostly getting untangled, many of the factors driving inflation in goods are being resolved.

But services are a tougher nut to crack, because you can’t make new, fully trained workers materialize out of thin air. We have a labor shortage that is driving inflation in the service sector.

Of course, this is getting resolved too … it’s just taking a little longer.

You might have missed it, but with the help of AI, driverless robotaxis are now roaming the streets of San Francisco 24 hours a day. It’s been debated for years, imagined in sci-fi for decades, and it’s finally happening. Right now.

It’s going to be a while before we start seeing the results of AI automation in inflation numbers. But we’ll get there. And in the meantime, we’re keeping our eyes open for opportunities here — like the new presentation Ian is giving next week on Tuesday.

Like he previewed today, it’s an investment opportunity that’s starting in small towns … and slowly sweeping across the rest of the U.S.

Want to learn more next week? Just sign up here.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

**Disclaimer: We will not track any stocks in The Banyan Edge. We are just sharing our opinions, not advice. We will, however, provide tracking, updates and buy/sell guidance for the model portfolio in your service subscription.